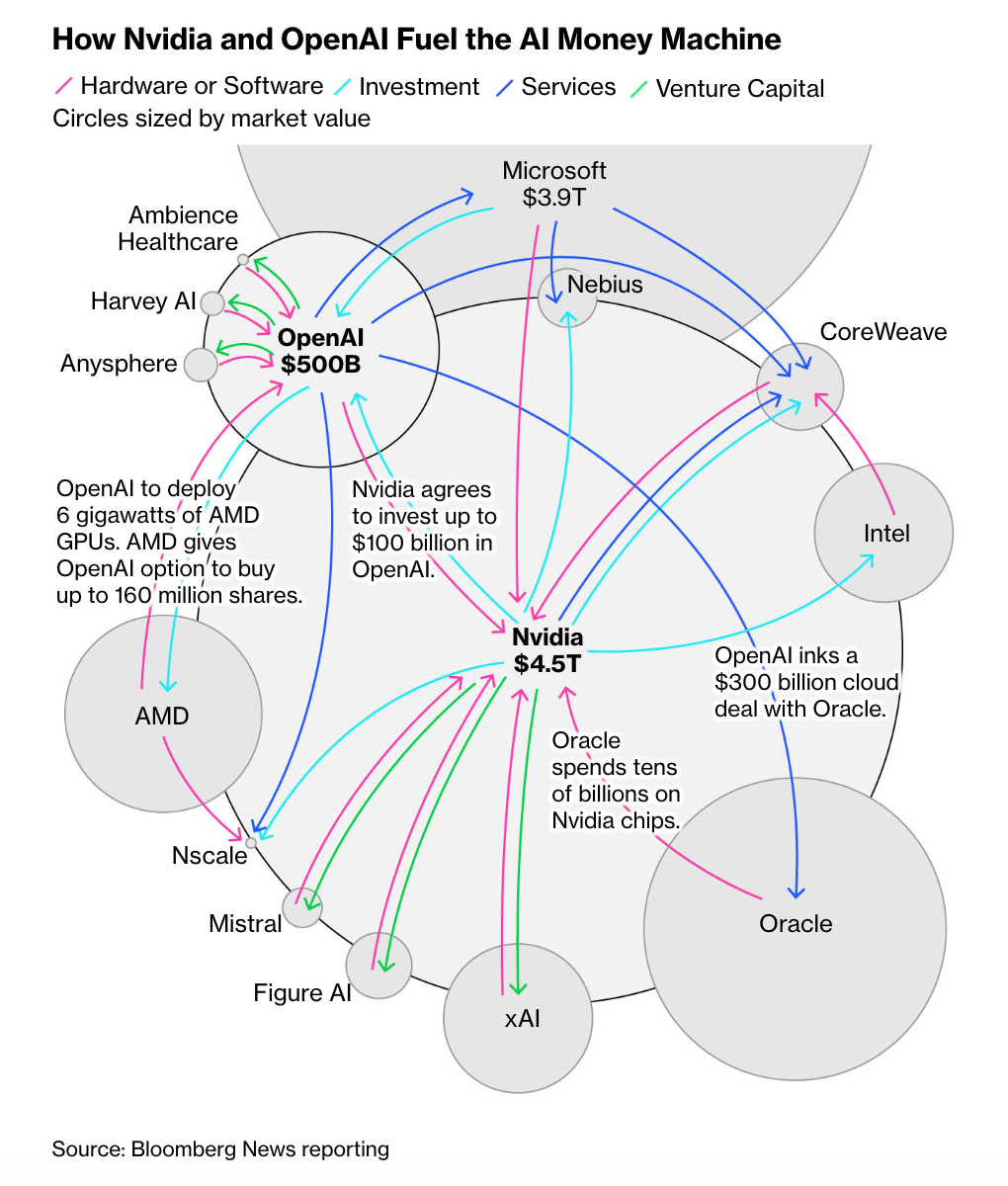

Interconnected and circular investment agreements between OpenAI, Nvidia, AMD and Oracle are driving more than $1 trillion across the AI market, raising major concerns about the sector’s sustainability. Bloomberg’s analysis, published on 7–8 October 2025, warned that these transactions may artificially inflate valuations, while the companies involved have yet to demonstrate long-term profitability.

Among the largest deals, Nvidia pledged up to $100 billion to OpenAI, which in turn committed to filling new data centres with Nvidia chips, while OpenAI also signed a multi-billion-dollar agreement with AMD involving chip purchases and equity stakes. In parallel, OpenAI struck a $300 billion cloud infrastructure deal with Oracle, which itself spends billions on Nvidia processors. A similar circular flow appears in the case of CoreWeave: Nvidia agreed to buy $6.3 billion worth of cloud services, while OpenAI committed up to $22.4 billion in compute spending. Taken together, these overlapping agreements suggest that much of the AI market is being fuelled by money circulating between the same players.

OpenAI’s valuation has already reached $500 billion despite the company remaining unprofitable and expecting to achieve positive cash flow only towards the end of the decade. Nvidia, now the world’s most valuable firm with a $4.5 trillion market cap, invested in 52 AI startups in 2024 and another 50 by September 2025. Analysts caution that if the market collapses, circular financing could be seen as the original trigger of the bubble. The risk of a crash comparable to the dot-com era is real, but the stakes are far higher this time: from energy and real estate to global stock exchanges, entire sectors are tied to the inflated expansion of the AI economy.

Sources:

1.

2.

3.